Yesterday,corn prices rose strongly,with an increase of 10-20 yuan/ton.Among them,the factory Baoji 2180 Linqing 2182 rose 10 Changle 2200 rose 16 to the station Nanchang 2190 rose 40 Jinzhou Port 2105 Shekou Port 2160.

The previous two temporary auctions have maintained the characteristics of high transaction and high premium.In both auctions,a total of 7,971,408 tons of corn were placed,and 7,796,265 tons were sold,with a total turnover rate of 99.94%.The range of premiums also varies from region to region,but the mainstream premium continues to remain high:the first-class corn mainstream premium is 110-120 yuan/ton,the second-class corn mainstream premium is 80-130 yuan/ton,and the third-class corn mainstream premium is 130-160 yuan/ton.After conversion into the market,it is 10-30 yuan/ton lower than the current market.

At the same time,from May 25 to June 8,Sinograin conducted 24 one-off reserve auctions,with a turnover of 910622 tons,a turnover rate of 71.88%,and a transaction price lower than market grain by 20-40 yuan/ton.

The high premium brought by the temporary reserve auction has a certain support to the price.Before the corn of the temporary reserve auction has yet to flow into the market on a large scale,traders'willingness to set prices has increased,and the supply is still tight in stages.Market focus is still on weekly auctions.Today's auction is expected to maintain a high turnover rate,supporting the market to maintain a strong trend.Affected by the twice high transaction rate and high premium rate of temporary reserve corn,and before the tightening of the corn supply situation,the price of corn remained generally strong.

On June 10,the National Grain Trading Center released the auction details for next week.On June 18,the auction of 4 million tons of corn was basically in line with the weekly auction volume of 4 million tons that we said before.The degree of premium has dropped to a certain extent,it can be concluded that the current market supply and demand relationship is not as tense as expected.

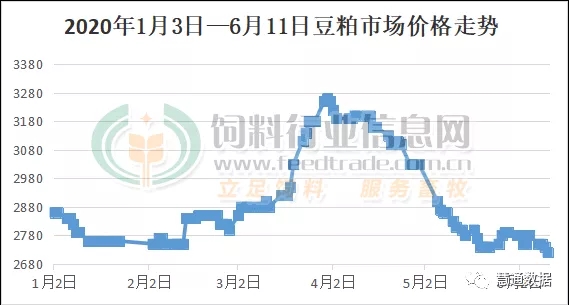

Supply pressure is high,soybean meal continues to fall weakly

US stocks closed up overnight due to improved Chinese demand.In terms of domestic soybean meal market,the domestic soybean meal market continued to run weaker by 10-20 yuan/ton due to the large domestic soybean arrivals and the continued rise in soybean meal stocks.The mainstream soybean meal price in coastal areas was 2620-2720 yuan/ton.However,it is worth noting that with the recovery of the pig industry's production capacity,the pork stocks have weakened,Wen's shares have fallen by nearly 2%,New Hope,Tangshen,etc.have fallen.The industry believes that the pig breeding industry will gradually return to normal,and the feed demand is expected.The improvement,meanwhile,the forward basis of soybean meal is already negative.In recent months,it has only hovered above and below the cost line.Therefore,soybean meal has bottom price support,and the market continues to fall.Therefore,it is expected to be limited.

In the short term,political factors in China and the United States have faded out of the soybean meal market,and the domestic soybean meal market has returned to the fundamentals of supply and demand.It is expected that the average monthly soybean arrival volume in June-August will exceed 10 million tons,and the loose domestic supply situation is still deepening.Therefore,Huitong data analysts believe that the soybean meal spot will be weaker for the most part of June.What needs to be reminded is that since the entire market is still closely focused on the Sino-US dispute,once there is any turmoil in the market,there is a risk of rising soybean meal spot,and the opportunities for periodic rises will be interspersed.Therefore,it is necessary for low inventory companies to increase their preparedness moderately in stock.